Irrespective of whether it’s making an investment portfolio, planning for retirement, preserving for faculty or buying a home, partnering by having an investment advisor may have many Positive aspects.

What you would like from a advisor variations as your life and career do, from early portfolio making to retirement planning and estate arrangements.

The services and assistance your adviser provides and what fees you pay will in the long run depend upon the contract you negotiate together with your adviser. Ensure you examine and recognize this agreement, in addition to the adviser’s partnership summary and Form ADV Component 2 Brochure.

Catering to substantial net worth individuals and family members, wealth supervisors have focused groups of monetary experts covering each and every element of investment advisory services.

Conducting an intensive inquiry into an adviser’s services, charge arrangements, and investment offerings will assist you to pick an adviser effective at serving your investment objectives.

How we earn money You might have revenue queries. Bankrate has solutions. Our professionals happen to be helping you grasp your money for over four decades. We frequently attempt to deliver shoppers Using the qualified assistance and tools required to do well through lifestyle’s money journey. Bankrate follows a rigorous editorial policy, in order to rely on that our content is honest and correct. Our award-profitable editors and reporters produce sincere and correct information that may help you make the right economic decisions. The articles made by our editorial team is goal, factual, rather than affected by our advertisers. We’re transparent about how we can easily deliver high-quality articles, competitive charges, and helpful applications to you personally by explaining how we make money.

In essence, These types of monetary advisors can make “appropriate” suggestions for clientele. When Individuals recommendations may very well be fantastic, they may not be the ideal or the most beneficial with the consumer’s predicament.

By spreading investments across many devices, they [attempt] to reduce threats connected with sector volatility although maximizing opportunity returns for their clientele.

These cost-free methods let you take a look at advisors’ locations of expertise, certifications, least investment necessities as well as the service fees concerned.

Their experience in industry Examination will allow them to recognize essential traits, dangers, and possibilities, enabling them to generate educated selections that optimize returns for their clientele.

How Monetary Advisors Are Paid out Being familiar with how your financial advisor will get paid assists you make smarter selections about who manages your cash. It can also reveal conflicts of interest that can influence their suggestions.

Effect on your credit could here range, as credit history scores are independently based on credit rating bureaus based on many components including the financial choices you make with other monetary services organizations.

Legacy and estate planning: Your advisor will help you produce crystal clear plans for prosperity transfer, charitable providing, and estate tax management that align together with your values and desires.

The tax liability depends on the holding period of the property: Shorter-phrase money gains: When the property is offered in two many years of possession, the gains will likely be taxed for the applicable particular person tax level.

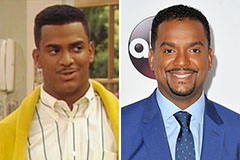

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!